How Personal Loans Affect Your Credit Score

Sep 16, 2024 By Kelly Walker

Advertisement

Are you considering taking out a personal loan? If so, it's important to understand how this type of loan might impact your credit score. While the details depend on your history and creditworthiness, a personal loan can help – or hurt – your overall financial standing.

In this blog post, we'll look in-depth at how personal loans affect your credit score and give tips for optimizing the outcome.

Understanding Your Credit Score

Your credit score is a three digit number which used by lenders to determine your ability to repay loans and other debts. It’s calculated using information from your credit report, based on how responsibly you use credit and manage debt. Your credit score can range from 300 (very poor) to 850 (excellent).

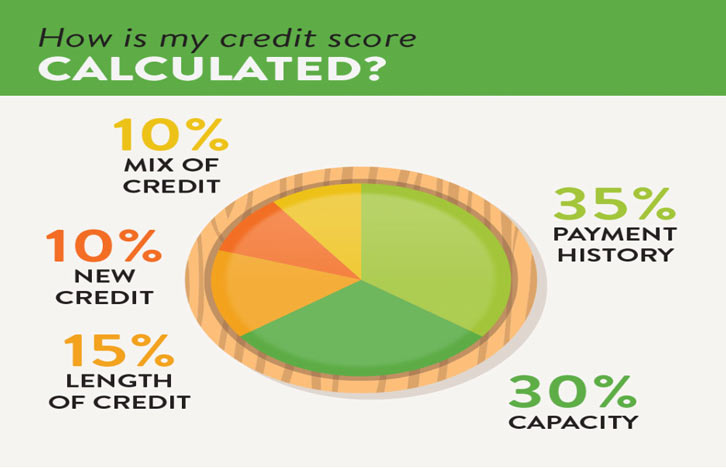

How Credit Score is Calculated

Your credit score is calculated using information from your credit report, which includes:

- Payment History (35%): This looks at how often you pay your bills on time and whether or not you have any late payments.

- Credit Utilization (30%): This looks at how much of your available credit you use. Keeping this ratio low (ideally below 30%) is best.

- Length of Credit History (15%): This looks at the average length of your accounts and how long it’s been since you last used them.

- New Credit Inquiries (10%): This looks at how often you apply for new credit, which can indicate financial difficulties.

- Types of Credit (10%): This looks at your credit accounts, such as revolving credit and installment loans.

By understanding how your credit score is calculated, you can make more informed decisions about managing your finances and build a strong credit history. While it’s important to keep an eye on your credit score, remember that it’s just one factor in determining whether or not you qualify for a loan. Other factors include your income and employment history.

The Impact of Taking Out a Personal Loan on Your Credit Score

Taking out a personal loan can help you build your credit score. When you take out a loan, the lender will pull your credit report to review your financial history and determine whether or not you are eligible for the loan.

This is a “hard inquiry,” which can affect your credit score. The impact is usually small and will only last a few months, but monitoring your score in the months following your loan application is important.If approved for the loan, paying it back on time every month can help increase your credit score.

Additionally, having a mix of different credit accounts (such as revolving credit and installment loans) can also help boost your score. Taking out a loan can be a great way to build credit, but it’s important to remember that missing payments or taking out too many loans can harm your credit score.

Ensure you understand any loan terms before signing up for one, and always make payments on time. Taking responsible steps to manage debt can help protect your credit score and build financial security.

Building Credit Through the Responsible Use of a Personal Loan

A personal loan can be a great tool for building credit when used responsibly. It’s important to understand that taking out a loan increases your debt, so you should only do it if you are confident you can make all the payments on time and in full.

Before taking out a loan, calculate how much you need and how much you can afford to pay each month. Also, shop for the best rates and terms that fit your budget.

Once you’ve taken out a loan, make sure you make all the payments on time. Late payments hurt your credit score and could lead to additional fees or higher interest rates. If you ever find yourself in a situation where you can’t make a payment, contact your lender immediately. They may be able to work out an alternative payment plan that won’t hurt your credit score.

Finally, your credit score will improve once you’ve paid off the loan and established a good payment history. As your score increases, you may be able to qualify for better loan terms or a larger line of credit.

Building credit through the responsible use of a personal loan is an excellent way to establish good financial habits and increase your credit score. By understanding how your credit score works, you can make more informed decisions about managing debt and building a strong credit history.

With the right approach, you can use a personal loan to build your credit score and achieve your financial goals.

Tips for Getting Approved for a Personal Loan With Good Terms

When applying for a personal loan, it’s important to understand what lenders seek. Here are some tips you can use to make sure your application is approved, and you get the best terms:

- Check your credit score and review your credit report before applying. This will give you an idea of where you stand financially and help you understand what you need to improve before applying for a loan.

- Shop around and compare different lenders to find the best terms. You can use online comparison tools to quickly compare offers from multiple lenders.

- Read the fine print carefully and ensure you understand all the terms and conditions before signing any documents.

- Be honest on your loan application. Lying or omitting information on a loan application can result in the denial of the loan.

- Consider prequalifying for a loan before you apply. This will give you an idea of what terms you may get and help you find competitive rates and terms.

- Make sure you can make the payments. Calculate how much you can afford each month and stick to that budget.

By following these tips, you can increase your chances of getting approved for a loan with good terms and save yourself from costly mistakes in the long run.

Alternatives to Taking Out a Personal Loan

If you need funds, there may be other options than taking out a personal loan. Many people turn to credit cards for short-term financing and other alternatives you can take advantage of, such as peer-to-peer lending, home equity loans, or even borrowing from family and friends.

Each option has risks and benefits, so it’s important to do your research before deciding. Credit cards can be a good choice if you need short-term financing, but they tend to have higher interest rates than personal loans.

Peer-to-peer lending is an increasingly popular option involving borrowing directly from other individuals rather than from a bank or financial institution. Home equity loans are another option, but you should be aware that they involve using the equity in your home as collateral and can be risky if you cannot make payments.

Borrowing money from family and friends can also be an option, but it’s important to approach the situation cautiously. If you’re unable to make payments, it could lead to a strain on your relationship. Therefore, it’s important to have a clear plan and timeline for repayment before taking out any loans from family or friends.

No matter what option you choose, it’s important to understand how personal loans affect your credit score. Taking out a loan and making timely payments can help you build a strong credit history, but it’s important to understand the risks before signing any paperwork.

With the right approach, using a personal loan responsibly can be an excellent way to improve your financial standing and achieve your goals.

FAQs

How do personal loans affect your credit score?

Personal loans improve your credit score if they are paid off promptly. Taking out a personal loan and making all your payments on time shows lenders that you're responsible with credit and can be trusted to pay back what is owed. This could result in an improved credit score over time.

How long does it take for my credit score to improve after paying off a loan?

It typically takes two to three months for your credit score to improve after you have paid off a loan. Credit bureaus need time to update their records and adjust your score accordingly. How quickly your credit score increases depends on the severity of negative entries on your report before paying back the loan and other factors such as your payment history and credit utilization.

How can I maximize the positive impact of a personal loan on my credit score?

The best way to maximize the positive impact of a personal loan is by consistently making payments on time, paying back the full amount due each month, and not taking out more loans than you can afford. Maintaining a good payment history is essential to improving or maintaining your credit score, as late payments can harm your report.

Conclusion

In conclusion, understanding the influence of personal loans on your credit score is essential for preserving and improving your overall financial well-being. By taking out a loan and paying it off as agreed, you can use this type of borrowing to safely improve your credit score in the long run.

Advertisement

Rick Novak Nov 26, 2024

Methods that Help Goldman Sachs Make Mone

38345

Kelly Walker Sep 16, 2024

How Personal Loans Affect Your Credit Score

93320

John Davis Nov 17, 2024

Beginner's Guide: 7 Simple Steps to Starting Your Instagram Blog

50352

Kelly Walker Dec 24, 2024

The Difference Between Payday and Installment Loans

53008

Kelly Walker Dec 16, 2024

A Comprehensive Comparison: Priceline vs. Hotwire

37911

Rick Novak Dec 07, 2024

Is Investing in Dividends a Good Strategy?

12055

Rick Novak Sep 04, 2024

Exploring Your Student Loan Repayment Choices

10068

Rick Novak Aug 24, 2024

Unveiling Shares Outstanding: A Comprehensive Guide

23228